Learn about State of Oregon including our Sustainability Bonds, News & Press Releases, Projects, and Team.

Talk to us

Have questions? Reach out to us directly.

Learn about State of Oregon including our Sustainability Bonds, News & Press Releases, Projects, and Team.

About State of Oregon

- Approved Budget for 2023-25

- $121 billion

- Total General Obligation, Appropriation, and Revenue Debt Outstanding (as of June 30, 2021)

- $11.29 billion

- General Obligation Ratings

- Aa1/AA+/AA+

Oregon is a coastal state in the Pacific Northwest region of the United States. The State is known for its diverse landscape of farms, forests, mountains and beaches. Oregon’s population is approximately 4.2 million ranking 39th among U.S. states in terms of population density and 9th among U.S. states in terms of land mass. Oregon is the home of nine federally recognized native American Indian tribes. Salem, the State’s capital, is located in Marion County, one of 36 counties comprising the State of Oregon. The North American Beaver is Oregon’s State Animal and the State is commonly referred to as the Beaver State. Oregon boasts over 362 miles of coastline from its southern border of California to its northern border of Washington. The State has many historic landmarks, national forests and wildlife refuge. Some of the State’s natural attractions include the historic Columbia River Gorge, Multnomah Falls, the snow-capped Mount Hood, the wine country of the Willamette Valley, Crater Lake, Ankeny wildlife refuge and many others. Metro Portland, the state’s largest city by population, is famous for its quirky, avant-garde culture and is home to iconic coffee shops, boutiques, farm-to-table restaurants and microbreweries.

Visit Oregon’s Blue Book for our rich history, natural resources, economy and culture.

Bonds are issued by the State of Oregon to finance critical infrastructure needs of the state. The State Treasurer, by statute, is the issuer of all State of Oregon debt and issues bonds at the request of the state agencies as authorized by the legislature to issue debt. The Treasurer issues debt on behalf of the Department of Administrative Services (DAS), Oregon Department of Transportation (ODOT), Oregon Business Development Department (OBDD), Oregon Department of Environmental Quality (DEQ), Oregon Housing and Community Services Department (OHCSD), Oregon Department of Energy (ODE) and Oregon Department of Veterans Affairs (ODVA).

In addition, the Treasurer approves the issuance of housing conduit revenue bonds issued through OHCSD and non-profit conduit revenue bonds through Oregon Facilities Authority (OFA).

Image Gallery

Sustainability Bonds

Learn about our environmental, social, and governance program, and how we bring those values to life with green bonds, sustainable projects, and more.

News

The Oregon Department of Administrative Services plans to price up to $550 million in lottery revenue bonds the week of April 7.

The deal will be more than twice the size of any of the state’s lottery revenue bond sales over the past eight years.

The bulk of the increase comes from a significant refunding component — approximately $250 million of the total $465 million in tax-exempt bonds are refundings, said Eric Engelson, a spokesman for the Oregon State Treasury.

The deal also includes an $85 million taxable component.

Oregon has averaged issuance of $185 million in lottery revenue bonds in each transaction over the past eight years. It sold $221 million in April 2024, $217 million in April 2022, $124 million in April 2021, $156 million in March 2019 and $230 million in March 2017.

The bonds planned for April will be priced by an eight-bank syndicate led by Jefferies and Loop Capital Markets.

For more information please click the article link below.

Bond Buyer released it’s 2023 “Deal of the Year” announcement where the State of Oregon was recognized as the Far West region winner. For more information please click the article link below.

More than $73 million to fund over 600 affordable homes

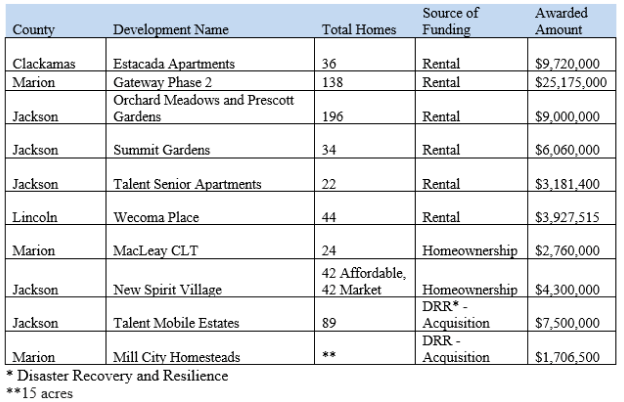

SALEM, Ore. — Oregon Housing and Community Services announced awards of more than $73.33 million for the construction of 625 affordable homes in wildfire-affected counties across the state. The Oregon Housing Stability Council (HSC) awarded the latest rounds of program funding during their past meetings. Most of the funding will go toward development of rental housing, and some will go toward homeownership.

These awards will add needed affordable housing supply in the counties of the state affected by wildfires, including the 2020 Labor Day Fires that burned 1 million acres. More than 4,000 homes were destroyed, including more than 1,700 manufactured homes in 20 manufactured home parks.

More than $7 million in funding will go to convert the Talent Mobile Estates into a resident-owned cooperative. The manufactured dwelling park was destroyed during the 2020 Almeda Fire in Jackson County, displacing 89 families. Many of the residents were Latino/a/x families who worked in agriculture and other low-wage service jobs. They have been displaced from their community for the past 20 months. The Phoenix-Talent School District reported that nearly 40% of its students lost their homes to the fire, causing a significant social, emotional and economic disruption. CASA of Oregon will work with its partner, Coalición Fortaleza, to engage residents displaced from the area as they develop the project.

“I’ve been spending a lot of time in Southern Oregon and the Latinx community has been disproportionately affected,” said HSC Councilmember Gerard Sandoval, PhD. “This is a perfect type of project that is needed because it has strong community ties and is resident-owned.”

The council also awarded funding to Marion County to buy 15 acres of land for future development of new affordable homes. The site has the potential to establish a mix of two- to-four-bedroom single-family homes for wildfire survivors, seniors and workforce housing in the Santiam Canyon.

“Currently, we have around 300 households in Marion County who don’t have a place to call home,” said Marion County Commissioner Danielle Bethell. “This $1.7 million is not just going to purchase land; it’s going to give us the opportunity to create affordable, long-term housing that works for this community that was devastated by the wildfires.”

Below is a list of the 10 affordable housing developments awarded funding in Clackamas, Jackson, Marion and Lincoln counties.

More detailed information about the awards and the funding programs can be found in the May 2022 and June 2022 Housing Stability packets.

Media Contact:Delia Hernández

HCS.mediarequests@hcs.oregon.gov

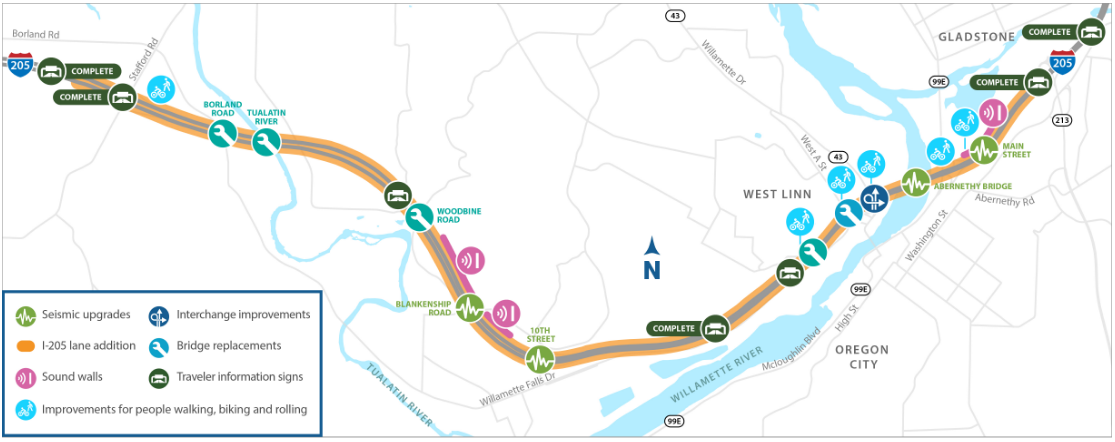

Projects

Team

George Naughton

Jaime Alvarez

Erica Hall

DAS: Rhonda Nelson

OHCSD: Siora Arce

ODOT: Ethan Pendlebury

ODVA: Nicole Dolan

Credit Summaries

Talk to us

Have questions? Reach out to us directly.